About Us

Veracity Leading Edge is a specialized management advisory firm. We work closely with the entrepreneur's vision and translate them into reality through our strategic advise and corporate financing functions. At VLE, entrepreneur's get one shop solution through our tie-ups in association with other verticals like Legal, Regulatory and Compliance, Taxation and HR Solutions. The team at VLE has shown up transparent, integrated and committed approach to its client and successfully nurturing our relationship through mutual respect.

Leadership (Advisory Board)

The VLE Leadership team is comprised of a diverse team of well recognized executives with vast business experience in Merger and Acquisitions, Tax, Legal, Structural Engineering, Architectural Solutions & Design, Financial Planning & Analysis, Product Lifecycle Management, Manufacturing Enterprise IT and innovation.

Sector

Currently Veracity Leading Edge LLP is serving the following sectors :

- Infrastructure

- Oil & Gas

- Real Estate

- Telecommunication & Media

- Consumer Goods

- Healthcare

- Hospitality

- Education

Gallery

Services

Career

If you want an environment that demands much and gives back even more, VLE is the place for you.

Challenging & Meaningful Work

Our professionals give their best in service to our clients. Commitment to excellence and constant innovation help our clients achieve long-term success. So, at VLE, hard work is encouraged; ideas are nurtured; innovation flourishes; and performance is rewarded.

Our ever-expanding business provides limitless opportunities for you to put your knowledge and technical abilities to work, but that's just the beginning. We want to develop, leverage and unlock the talent in every individual who works for VLE.

Contact Us

We are always ready to help you. There are many ways to contact us. You may drop us a line, give us a call or send an email, choose what suits you most.

Services

Lorem ipsum dolor sit amet, consectetur adipisicing elit, sed do eiu

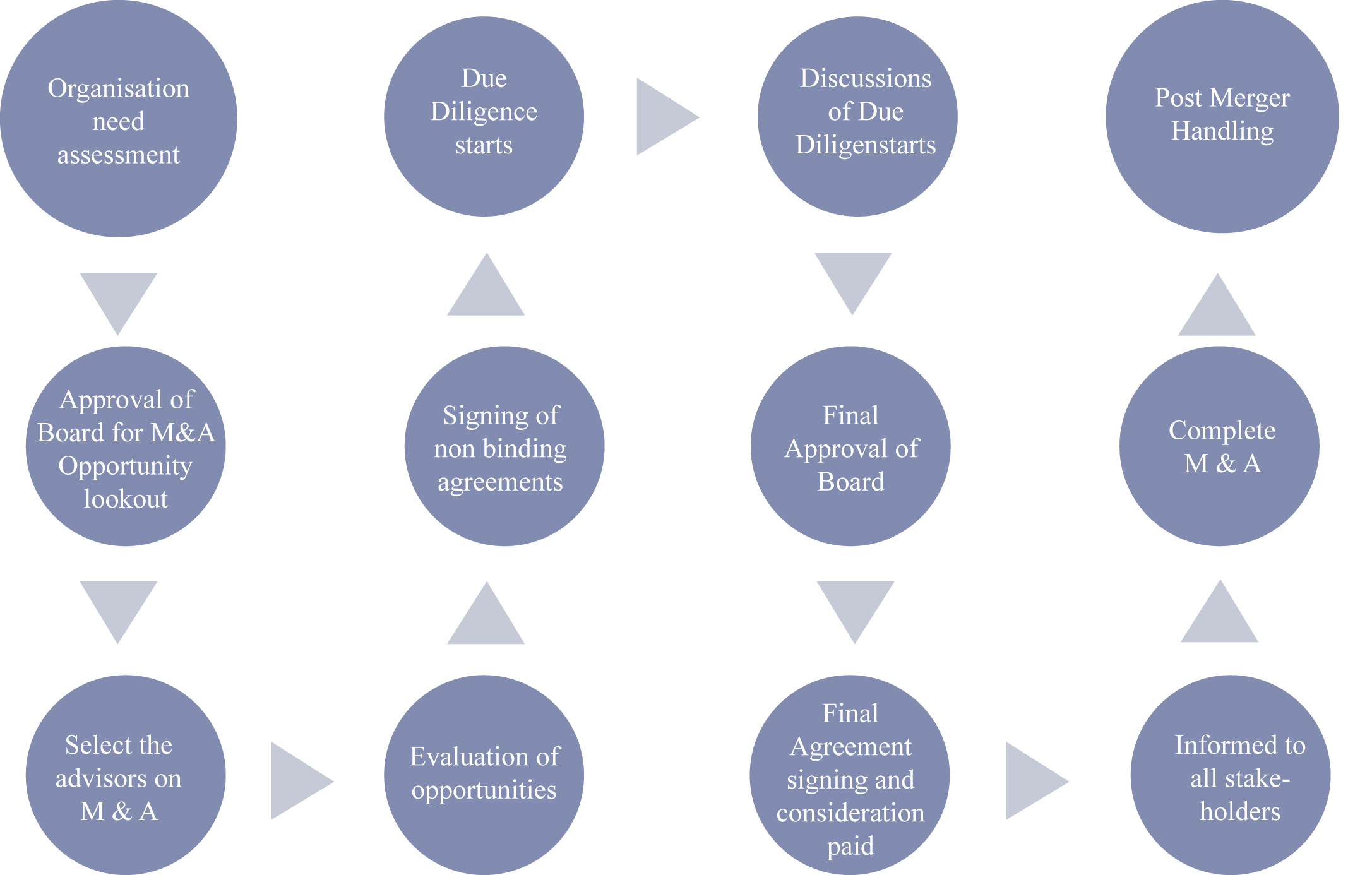

Mergers And Acquisitions

We help our clients in validating their M & A Strategies and assisting them end to end and creates overall values for them. We work with chief financial officers on finance organization, portfolio strategy and major investment decisions; linking corporate strategy to capital market performance; investor communications; ensuring that M&A and other transactions are consistent with the overall strategy. In todays, scenario, justifying the value of businesses has grown more complex and challenging as valuation as its been accepted that valuation is not an exact science and depends upon a number of factors like purpose, stage, financials, industry, management and promoters strengths etc.

As the pace of competitive change accelerates, Corporate Development is becoming a strategic necessity. Organizations need to be nimble in anticipating growth opportunities and competitive disruption, leveraging scarce resources and diversifying risk. Flexibility is critical as companies will need to be able to adapt their strategies in real time to avoid being left behind. M & A is needed for them and we are here for support them. The rapid globalization of the world economy has created both opportunities and challenges for organiations leading to uncertainty blowing across global markets and raising the importance of independent valuations all over the world.

a) Startup Valuation

b) Brand Valuation

c) Enterprise Value